We recommend backing up every data point from your previous service, for your own archival purposes. This allows future updates to those objects to sync.WHAT DATA CAN BE EXPORTED FROM QUICKBOOKS INTO BILL4TIME? The initial sync will bring in both active and inactive objects (chart of accounts, vendors, customers, etc.).Since the sync queries for recent updates, the next sync will now pull in that invoice due to the update. If an invoice older than 90 days need to be synced over to, select Edit and then Save on the invoice - this will trigger an update.The sync will only pull in invoices created or updated within the last 90 days from the date the sync is first set up.The sync setup with QuickBooks Online is now complete. Select Sync and Sync Now to run another sync.Turn on any other settings that will need to be available in.The following settings will be set based on settings within QuickBooks Online:

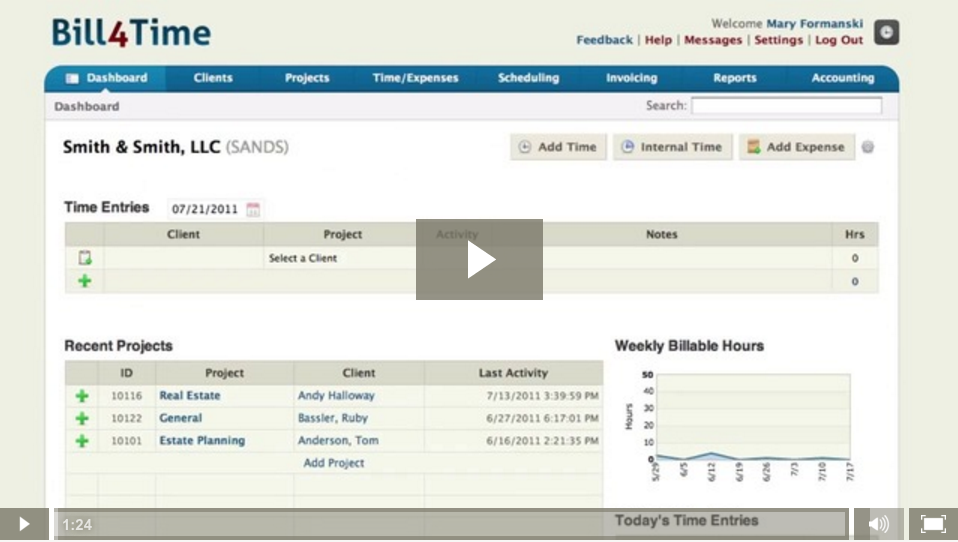

#Quickbooks to bill4time software

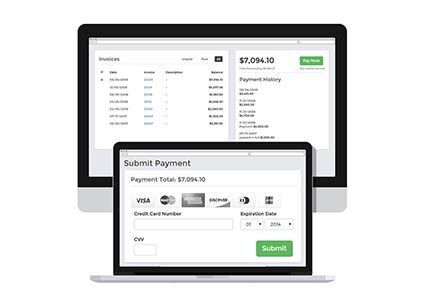

However, the sync can always be run more often manually via the Sync Now button. Checking this box ensures that the sync is run at least once daily.Select the QuickBooks Online accounts to use (we filled the list with your QuickBooks Online Chart of Accounts during the first sync) for the following settings (if applicable):

Some fields will be pre-filled, review to ensure the corrects accounts have been selected. Sync preferencesĪfter the first sync completes, fill out sync preferences.

#Quickbooks to bill4time full

Select Sync now to start the first full sync.Select the GL account from your chart of accounts for uncategorized expenses and select Next.Select the GL account from your chart of accounts that matches any bank accounts you added and select Next.

Select Set Up after the first import of chart of accounts completes.Select the company in QuickBooks Online you want to sync to your account and select Connect.Enter your QuickBooks Online Primary Admin user ID and password, and Select Sign in.Select Set Up Sync on the Sync accounting software step of the Get Started page.: A user with the Administrator or Accountant role is required (or custom role with manage company and sync permissions).QuickBooks Online: To connect the sync, a Primary Administrator or Company Administrator is required.In order to complete the Sync Setup steps listed below, please note the following requirements: The following image shows what objects sync and in which direction.Īccounts under accountant consoles or signed up before 9/15/17Īccounts signed up after 9/15/17 not created under an accountant console This guide will walk you through setting up the sync with QuickBooks Online.

0 kommentar(er)

0 kommentar(er)